亲爱的FRM学员:欢迎来到融跃教育FRM网!

距离2026年5月9日FRM一级考期还有 天!

全国热线:400-963-0708

全国热线:400-963-0708  网站地图

网站地图

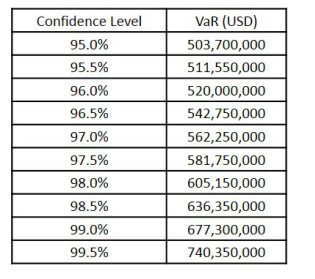

A money management firm has USD 33 billion in assets. The risk manager computes the daily VaR at various confidence levels as follows:

What is the closest estimate of the daily expected shortfall at the 96.5% confidence level?

AUSD 543 million

BUSD 588 million

CUSD 634 million

DUSD 740 million

打开微信扫一扫

添加FRM讲师

课程咨询热线

400-963-0708

微信扫一扫

还没有找到合适的FRM课程?赶快联系学管老师,让老师马上联系您! 试听FRM培训课程 ,高通过省时省心!