亲爱的FRM学员:欢迎来到融跃教育FRM网!

距离2026年5月9日FRM一级考期还有 天!

全国热线:400-963-0708

全国热线:400-963-0708  网站地图

网站地图

发布时间:2021-06-10 09:32编辑:融跃教育FRM

在FRM一级考试中,Hedging Using Futures Contract是其中内容之一。备考中的考生要对其内容有所了解。下文是小编为你介绍的相关内容,一起了解一下!

Short Hedges:

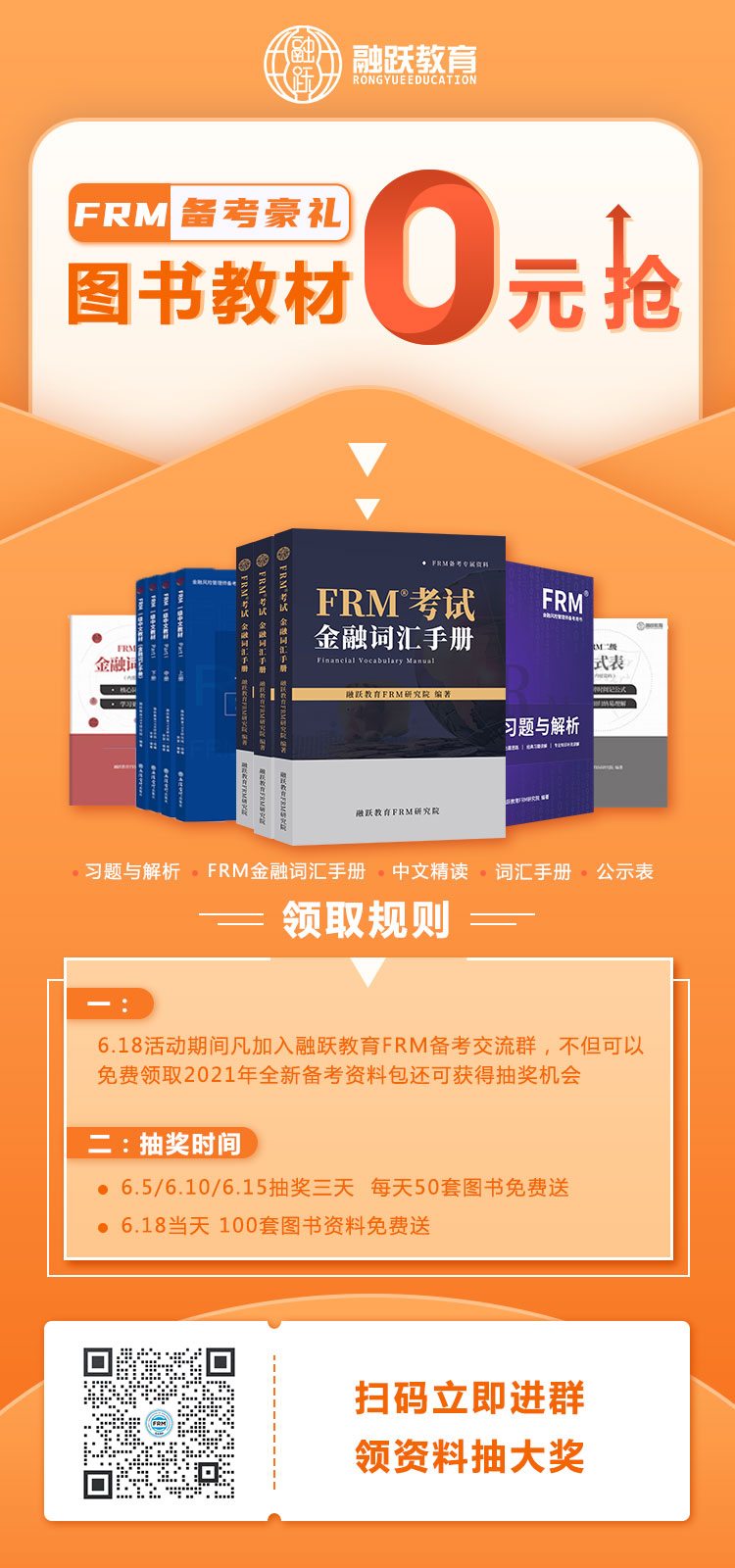

A short position in futures contracts;》》》2021年新版FRM一二级内部资料免费领取!【精华版】

Appropriate when the hedger already owns anasset and expects to sell it at some time in thefuture;

Long Hedges: ž

A long position in a futures contract;

Appropriate when a company knows it will have to purchase a certain asset in the future and wants to lock in a price now;

Arguments for hedging:

Reduce price risk;

Less uncertainty;

Arguments against hedging:》》》融跃教育618抢先购——千元礼包1元购

less profitability;

shareholders can easily hedge risk;

nature of the hedging company’s industry;

Basis Concept:

Basis=SP-FP;

Basis =0 at maturity;

spot price increases faster(slower) than the futures price over the hedging horizon, basis increases(decreases);

Problems give rise to basis risk:【资料下载】点击下载FRM二级思维导图PDF版

The asset whose price is to be hedged may not be exactly the same as the asset underlying the futures contract;

There may be uncertainty as to the exact date when the asset will be bought or sold;

The hedge may require the futures contract to be closed out before its delivery month;

FRM考试的内容就分享这么多,学员如果还有更多的内容想要学习,可以在线咨询老师或者添加老师微信(rongyuejiaoyu)。

上一篇:FRM知识点分析:Credit Risk Management

下一篇:shadow bank(影子银行)在FRM考试中的特点有哪些?

热门文章推荐

打开微信扫一扫

添加FRM讲师

课程咨询热线

400-963-0708

微信扫一扫

还没有找到合适的FRM课程?赶快联系学管老师,让老师马上联系您! 试听FRM培训课程 ,高通过省时省心!